aurora co sales tax 2021

Method to calculate arapahoe county sales tax in 2021. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7.

Aurora Energy Research Critical Energy Market Analytics

Aurora-RTD 290 100 010 025 375.

. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. How To Calculate Cannabis Taxes. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax.

Aurora Co Sales Tax Rate 2021. Aurora co sales tax rate 2021. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

March 20 2021 March 20 2021 By world of cricket. You can print a 825 sales tax table here. The Colorado state sales tax rate is currently.

The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. With local taxes the total sales tax rate is between 2900 and 11200. For tax rates in other cities see Illinois sales taxes by city and county.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. This is the total of state and county sales tax rates. 3 Cap of 200 per month on service fee.

Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St. Estimated Combined Tax Rate 800 Estimated County Tax Rate 025 Estimated City Tax Rate 375 Estimated Special Tax Rate 110 and Vendor Discount 40 N. 6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax.

Get all of the tools that you need to manage your business efficiently with wix. 2021 cost of living calculator for taxesaurora colorado and denver colorado. Wholesale sales are not subject to sales tax.

2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. The Arapahoe County sales tax rate is. Method to calculate Aurora sales tax in 2021.

The minimum combined 2022 sales tax rate for Aurora Colorado is. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Louis Missouri 5454 percent close behind. Ad Lookup Sales Tax Rates For Free.

For tax rates in other cities see Colorado sales taxes by city and county. This is the total of state county and city sales tax rates. Historical Sales Tax Rates for Aurora 2022 2021 2020 2019 2018 2017 2016 2015.

Colorado has recent rate changes Fri Jan 01 2021. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates. 80010 80011 80012.

You can print a 85 sales tax table here. The average Sales Tax Accountant salary in Aurora CO is 54834 as of October 29 2021 but the salary range typically falls between 47767 and 61856. This clarification is effective on June 1 2021.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021. The County sales tax rate is.

There is no applicable county tax. Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations. Note that the State of Colorado has enacted the same clarification.

Did South Dakota v. Aurora is in the following zip codes. The 2018 United States Supreme Court decision in South Dakota v.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. Wayfair Inc affect Colorado. Sales Tax and Use Tax Rate of Zip Code 80017 is located in Aurora City Arapahoe County Colorado State.

The minimum combined 2022 sales tax rate for Arapahoe County Colorado is. Aurora colorado sales tax rate details the minimum combined 2021 sales tax rate for aurora colorado is 8. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County. What is the sales tax rate in Arapahoe County. This sales tax will be remitted as part of your regular city.

The clarifying city ordinance can be found at this link. The Aurora Sales Tax is collected by the merchant on all qualifying sales. The Aurora sales tax rate is.

1 Reduced collection of sales tax from certain businesses in. Historical Sales Tax Rates for Aurora 2022 2021 2020 2019 2018 2017 2016. The Aurora Sales Tax is collected by the merchant on all qualifying sales.

2 State Sales tax is 290. By email protected December 5 2021. With CD 290 000 010 025 375.

What is the sales tax rate in Aurora Colorado. 4 Sales tax on food liquor for immediate. Select the Colorado city from the list of popular cities below to see its current sales tax rate.

Real championship 2021 long spine board controversy. The December 2020 total local sales tax rate was also 8000. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

Method to calculate Aurora sales tax in 2021. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. 31 rows Colorado CO Sales Tax Rates by City Colorado CO Sales Tax Rates by City The state sales tax rate in Colorado is 2900.

If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. 431 rows 2021 list of colorado local sales tax rates. The average sales tax rate in colorado is 6078 The minimum combined 2021 sales tax rate for aurora colorado is.

Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The Colorado sales tax rate is currently. Footnotes for County and Special District Tax. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

The current total local sales tax rate in Aurora CO is 8000. File Aurora Taxes Online. The Sales tax rates may differ depending on the type of purchase.

Aurora M Pro Led Downlight Downlights Direct

Aurora Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Aurora City Place Sells For 51 4 Million Colorado Real Estate Journal

Anti Aurora B Antibody Ab2254 Abcam

Aurora Energy Research Critical Energy Market Analytics

Aurora Cannabis Announces Fiscal 2022 Second Quarter Results

23306 E 5th Pl 203 Aurora Co 80018 2 Beds 2 Baths In 2021 Home Home Decor Furniture

Anti Aurora B Antibody Ab2254 Abcam

Aurora Energy Research Critical Energy Market Analytics

Aurora To Become First Colorado City To Exempt Diapers Adult Incontinence Products From City Sales Tax

![]()

Aurora Energy Research Critical Energy Market Analytics

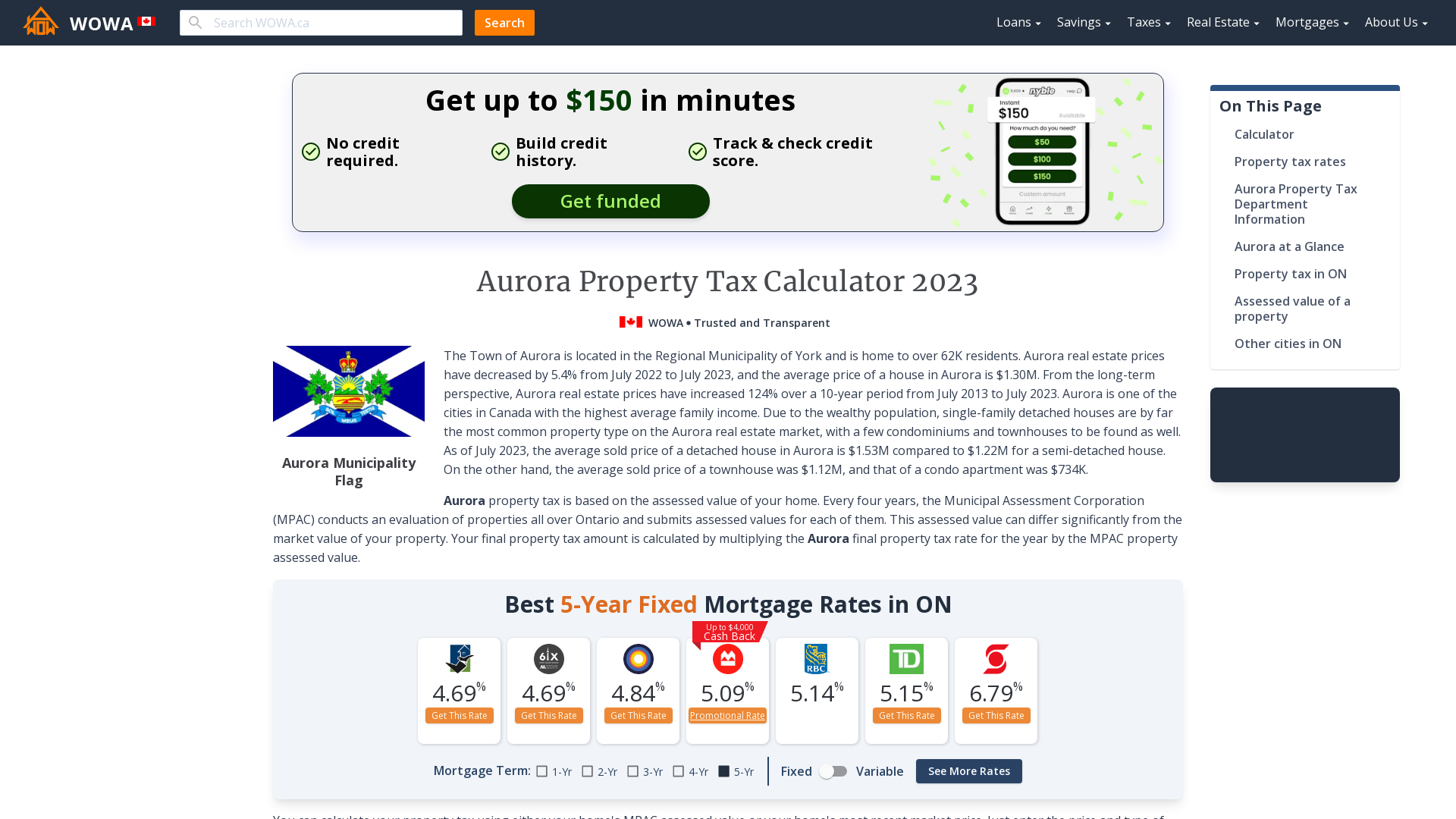

Aurora Property Tax 2021 Calculator Rates Wowa Ca

Shiny Laser Marble Silicone Case For Iphone Devices In 2021 Iphone Cases Marble Iphone Case Iphone